What changes will there be to cost accounting?

Assign times or costs to an order item

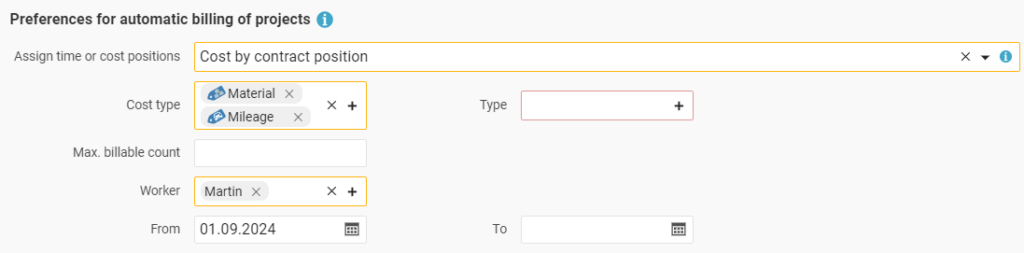

We have added a new function to the expense items in your order so that you can see the billing-relevant cost elements in the order. You can now assign either times OR costs.

This means that costs can now be billed in the same convenient way that you are already used to with times. If you set the order item to costs, it collects all suitable chargeable costs and automatically transfers them to the next invoice. You no longer have to assign the costs retrospectively.

As with times, you can limit the allocation according to certain criteria. These include

– Cost type: material, travel costs, etc

– Type: 19% VAT, 7% VAT etc.Processor: The person who submitted the costs.

– Period: Time period within which costs are taken into account.

– Maximum number: Maximum number of cost elements that can be charged via this item.

You also have the choice of whether the cost elements are listed individually in the invoice (costs via collective billing) or whether the assigned cost elements are all included in the underlying order item and increase the amount there (costs via the order item).

Record costs and define billing type

Re-invoicing incoming invoices

With extended billing, you can even convert incoming invoices into cost elements and bill your customers in the same way. This makes it much easier to invoice external services. This process is particularly convenient if you already receive the incoming invoice in the new ZUGFeRD and XRechnung e-invoice formats, as the invoice data is then read digitally and transferred directly to your document.

PS: The conversion also works in reverse. In this way, you can quickly and easily generate a hotel invoice with cost items for accommodation and breakfast that have different VAT rates.